E-commerce in Latin America: Digital doorways and stumbling blocks

Carlos Victoria, VP Oracle; Ernesto Echeverry, LATAM; Guida Sousa, Masterpass

Buying through your smartphone is smooth and seamless in the United States, be it for shoes, books, airlines tickets or Uber rides. Yet for Latin America consumers, roadblocks to e-commerce range from cyber security to banking limitations, home-delivery concerns to government regulations.

Ways to overcome those obstacles and seize opportunities for e-commerce in Latin America were the focus of WorldCity’s Global Connections held Oct. 21, 2016, in Coral Gables.

Giving their views from time spent in the region were Carlos Victoria, vice president for Oracle Retail Latin America; Ernesto Echeverry, LATAM Airlines’ director of marketing for USA, Canada & Caribbean; and Guida Sousa, leader of Masterpass initiatives in Latin America and Caribbean for Mastercard’s Digital Payments team.

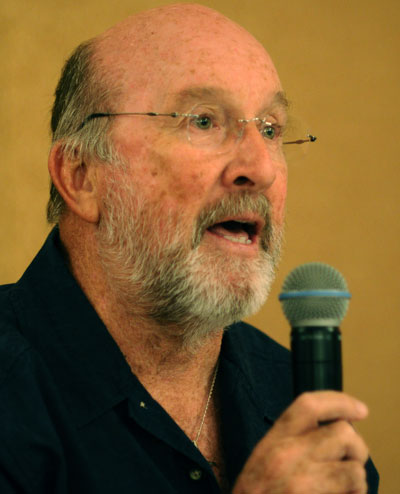

John Price, American Market Intelligence

Joining the panel as well was John Price, co-founder of research firm Americas Market Intelligence, which recently released a white paper on digital payments in Latin America.

Opportunities from rising smartphone use across Latin America

To set the stage, the four panelists offered a look ahead while also noting concerns.

“The highest expectation is to see leaders in the market invest and promote online purchasing, and work with governments and regulators to make it easier,” said Oracle’s Victoria, while worries persist about cyber security and fraud.

For LATAM’s Echeverry, opportunities center around the region’s increasing mobile phone penetration, while concerns include keeping up with the racing pace of technology.

Fedex Latin America

Researcher Price said he was most hopeful about increases in the digital selling of goods and services regionwide, even as governments worry about disruption of traditional sectors (think Uber).

“Outside the 10 largest Latin America cities, retail only covers the basics,” Price said. When it comes to finding luxury or out-of-the-ordinary items, choices are few. So the digital economy “becomes a natural channel through which you will source that stuff,” said Price.

To be sure, conditions in different countries vary and affect adoption of e-commerce.

Diversified, Esslinger Wooten Maxwell, Boston Scientific

In Mexico City, for example, worries over personal safety worries buoy transport service Uber, because consumers like its digital tracking feature. In retail, truck delivery services are looking at plans for drivers to drop off packages at a secure facility for later customer pick-up, said Price.

Low penetration of credit cards crimps e-commerce

One key obstacle for digital sales continues to be low credit-card penetration — only 30 percent to 40 percent across the Latin American region, said Price.

That is where initiatives like Masterpass come in, said MasterCard’s Sousa. Masterpass lets consumers connect with merchants, banks and even other credit cards through a single channel.

Council of the Americas

The streamlined approach appeals to millennials, who make up a growing share of consumers. “These people are more and more connected,” Sousa said. “We are in a world driven by young people. They are not used to friction. What they want is now, easy and secure.”

The initiative also builds on digital options already offered across the region by banks, which Latin America consumers tend to trust, she said. “A huge number of consumers drop in the middle of a transaction if they have to put in lots of info” like addresses, phone numbers and credit card numbers.

Must people have bank accounts to use Masterpass?, asked audience member Tak Takasu, managing consultant at Competitive Intelligence & Strategic Analysis, referring to millions regionwide without accounts.

Customers do need a bank account, replied Sousa, although the company offers other options for the unbanked.

Also crimping e-commerce: many people in Latin America who have credit cards don’t qualify for higher credit limits, said Victoria. “That is one reason there is a lack of credit for digital payments available.”

How, asked Eddie Sarasola, vice president of media production company Natcom Global, do companies cope with those low credit limits? “Most only have $500,” he said.

TransForma, Cartier

“That is a huge problem,” said Price. Not only is Latin America under-served by credit reporting agencies, but laws and regulations in the region tend to favor “the renter and lendee, not the lender,” boosting risk for banks, he said.

Stepping up customer service in Latin America

Attendees asked how newer tech companies deal with customer service issues.

“The problem is after things go wrong,” said Leopoldo Coronado, executive director of Year Up South Florida, an empowerment initiative created in concert with Miami Dade College. “These companies outsource everything,” including customer service.

The high degree of multiple players won’t change, Price said. Still, he noted, “You as the consumer hold the key.”

Amazon, said Victoria, is one company that tackles unhappy customers head on, offering an example to follow. “You have an issue, they solve it immediately,” he said.

MSH team

The future: A lot more talking to robots?

Audience members also asked about how to reconcile the relatively low purchasing power of the Millennial generation with their high rates of technology adoption.

“The purchasing power isn’t there for the Millennials,” noted Efraín Sorá, president and CEO of Sora Global Insurance & Consulting, wondering how companies can both cater to their tastes and pursue profit.

Echeverry said the key lies in knowing one’s customer. “One of the things we should be focused on is understanding what the consumer wants to purchase and how,” he said. “These guys will have the purchasing power in five years.” Companies need to plan for new buying habits. The future, he predicted, will hold a lot more talking to robots.

Global Connections is one of four event series put on by WorldCity to bring together executives in greater Miami on international business topics. The Global Connections series is sponsored by Florida International University’s College of Business and Audicom Productions.

The next Global Connections on Nov. 18, 2016 will be WorldCity’s “Third Annual Health Care Forum: Pharma, Devices and More.”